iGaming Law

Navigating the Complexities of Corporate Group Licences: Advantages, Challenges, and Key Conditions

Author: James Bartolo

Navigating the Complexities of Corporate Group Licences: Advantages, Challenges, and Key Conditions

9 min read

Author: James Bartolo

Overview

In an era marked by rapid digital transformation and evolving regulatory frameworks, the corporate world is navigating new complexities, particularly within the gaming industry. The Gaming Authorisations Regulations 2018[1] (hereinafter referred to as the “Regulations”) allows corporate entities to streamline operations through corporate group licences. This article explores how these licences offer advantages, the challenges they present, and the key conditions under which they operate, all in the context of today’s dynamic business environment.

Concept

In accordance with the Regulations, where the applicant for a licence is a body corporate, such applicant may apply for a licence either on its own behalf or on behalf of its corporate group, where different entities pertaining to the same group of companies that offer services related to gaming – whether critical, material, and/or non-material – may all apply to be recognised as an authorised person.

The term ‘corporate group’ is defined as a group of bodies corporate all established in the European Economic Area, or otherwise structured in a manner which provides equivalent safeguards, in which a parent entity exercises control to the extent of over ninety percent (90%) over other bodies corporate in the same group, whether by way of shareholding or voting rights[2].

Where a licence application is filed on behalf a corporate group, all references in the Regulations to an applicant are deemed to refer to each and all members of that corporate group. Moreover, where a licence is granted, each member of the corporate group jointly and severally shall be deemed to be a licensee[3].

Advantages

Where larger organisations have in place a group structure, opting to apply for a corporate group licence rather than a singular licence has its benefits. The more significant advantages include:

Segregation of Services

With the increasing trend towards outsourcing, the ability to segregate services within different group companies becomes crucial. If a company wishes to outsource material and/or non-material services through different companies within the group, a singular licence[4] would only allow this facility if the licensed operator fulfils the criteria set out through the MGA Policy on Outsourcing by Authorised Persons 2018[5] (the “Outsourcing Policy”).

In outsourcing critical services[6] however (or material services that are not able to be outsourced in line with the Outsourcing Policy), such services would not be able to be outsourced unless the outsourced service provider holds a separate MGA authorisation[7].

The advantage of a corporate group licence is therefore that all entities within the authorised corporate group are deemed to be an authorised person. As a result, the provision of services from one entity in the corporate group licence to another would not be classified as outsourcing and would be deemed to be carried out by the licensee, exempting such entities from applying for separate authorisations, as the case may be.

Licence Fees

As businesses face tighter financial scrutiny and the need for cost efficiency, the single annual licence fee under a corporate group licence is a significant advantage.

As previously discussed, since outsourcing critical and certain material services to an unauthorised person is not permissible unless the outsourced service provider holds an MGA authorization. Accordingly, any third-party companies providing such services must obtain separate MGA authorisations. This results in multiple license fees being levied annually within the group.

However, for corporate group license holders, all entities within the corporate group are jointly recognised as authorised persons and regardless of the number of entities falling under the corporate group licence, only a single annual license fee is payable. By consolidating licensing fees, companies can allocate resources more effectively, supporting innovation and growth amidst fluctuating economic conditions.

Recognition

Under a singular licence, any contracts with business partners, including outsourcing and licensing agreements, must be directly entered into with the licence holder entity (as receiver of the outsourced service). However, when corporate group entities are jointly recognised as authorised persons, the contractual landscape changes.

In this scenario, contracts and agreements with third parties can be entered into with any authorised corporate entity within the group, providing greater flexibility and streamlined operations across the corporate structure. This is especially pertinent given the rise of cross-border operations and partnerships, which demand seamless regulatory compliance.

Disadvantages

Before opting to pursue a corporate group licence however, applicants should bear in mind other considerations.

Joint Liability

Any negative press encountered by a single corporate entity—whether due to breaches of regulations, lawsuits, or adverse media references—can potentially jeopardise the entire corporate group. This risk has become more evident with the rise of digital platforms and heightened scrutiny from regulators and the public.

As a result, for high-risk companies and ultimate beneficial owners, applying for separate licenses may prove to be a more prudent approach, to contain reputational damage and restrict legal ramifications to one company within the group.

External Service Offering

When an entity within a corporate B2C licence provides a critical gaming supply service, whether operating in or from Malta or through a Maltese legal entity, to entities not covered by the corporate group licence, such an entity is required to obtain a separate B2B licence. Therefore, even within the streamlined structure of a corporate group licence, entities within the group would still need to adhere to additional licensing protocols when engaging in business with external partners in order to uphold the high standards of accountability and regulatory oversight that are required by the regulator.

Conditions

For an operator to be eligible to apply for a corporate group licence, the below criteria must prevail:

- Corporate Entities forming part of the corporate group licence must be established within the European Union or European Economic Area (or any other reputable jurisdiction as deemed fit by the MGA)[8];

- Corporate Entities must be at least 90% owned by the same shareholder and/or beneficial owner of the licence holder entity;

- Corporate Entities must offer a critical, material and/or non-material service related to gaming, to the corporate group.

Other Important Notes

In a singular licence, the licence holder must submit bi-annual financial statements to the Malta Gaming Authority and any shareholding companies are exempt from this requirement. In a corporate group licence however, all authorised persons within the corporate group are required to submit segregated management accounts and annual financial statements to the Authority.

From a fit and proper standpoint, since corporate entities are jointly recognised as an authorised person, criminal probity screening checks by the Authority are carried out on all corporate entities applying for recognition, their directors, and their shareholders and UBOs (holding 10% or more direct or indirect qualifying interest).

A corporate group licence holder is required to submit a declaration, signed by the Directors of all corporate entities, explaining the type of services being provided by each entity. Furthermore, for entities providing critical supplies to the corporate group, the Authority reviews the service agreement between the corporate entity and the licence holder.

Scenarios

Following the explanation of the different components and requirements of a corporate group licence, the below examples illustrate different corporate structures and their eligibility to apply for a corporate group licence authorisation.

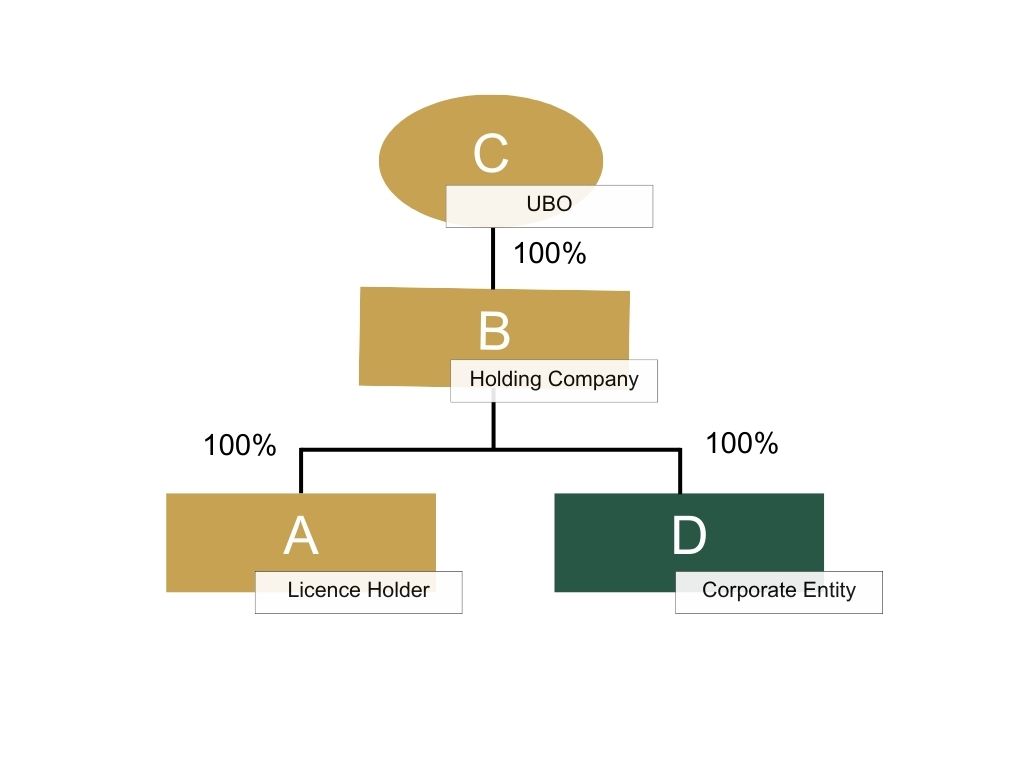

Eligible Person

Entity A offers a Type 1 (Casino) gaming service. This entity is the holder of the licence, responsible for entering into contractual agreements with players. Company D licenses[9] the gaming software and respective games for company A to make use of while running the gaming operation. Under a singular licence application, company D would be required to apply for a critical gaming supply licence since gaming software is considered as a critical service.

With the use of the corporate group licence however, company A would be able to apply for a corporate group gaming service licence, also recognising company D as a corporate entity. In this way, company D would not be required to apply for its separate licence – provided that the gaming software is only provided within this corporate group.

Non-Eligible Person

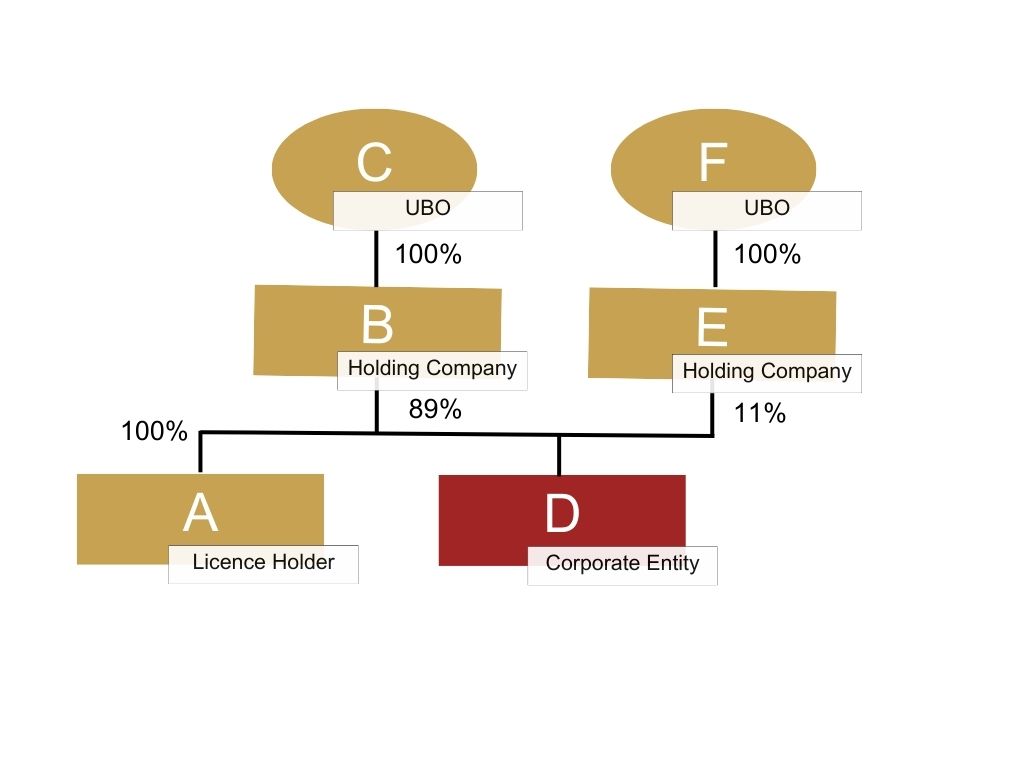

Like the previous example, company A offers a Type 1 (Casino) gaming service and company D licenses the gaming software and respective games.

Since company D is not at least ninety percent (90%) owned by the same parent company of company A (the licence holder), the latter is not eligible to apply for a corporate group licence recognizing company D as a corporate entity. As a result, company D must apply for a separate licence should it still wish to provide the gaming software to company A.

Conclusion

In conclusion, the decision between opting for a corporate group licence or an individual licence is pivotal for businesses in the gaming industry. Corporate group licences present significant advantages, including cost savings, streamlined internal operations, and flexibility in service provision within the group. These benefits make them particularly appealing for large corporate entities with interconnected operations. However, the associated joint liability and restrictions on external service offerings cannot be overlooked. These potential risks necessitate a careful evaluation of the company’s structure, risk profile, and strategic objectives.

For high-risk entities or those with substantial external partnerships, individual licences might provide better segregation of liability and compliance flexibility. On the other hand, corporate groups seeking operational efficiency and reduced administrative burdens may find corporate group licences to be a more strategic choice.

Ultimately, understanding the specific needs and regulatory environment of the business is crucial in making an informed decision that aligns with long-term goals and compliance requirements. By weighing the pros and cons outlined in this comparative analysis, companies can navigate the complexities of gaming licences effectively and choose the path that best supports their growth and stability.

[1]Gaming Authorisations Regulations 2018

[2]Gaming Definitions Regulations 2018

[3]Article 10(3), Gaming Authorisations Regulations 2018

[4]A Gaming Service Licence or a Critical Gaming Supply Licence

[5]Policy on Outsourcing by Authorised Persons 2018

[6]First Schedule, Gaming Authorisations Regulations, 2018.

[7]A licence or recognition

[8]A UK entity is only eligible to apply for a licence with the MGA if it has set up or acquired a legal person, including through capital participation, or has created a branch or representative office in an EU Member State, with a view of maintaining lasting economic links in that Member State.

[9]Providing in this context refers to leasing such software, where company D shall be managing, hosting and controlling the platform. A developer who sells its software to company A shall not be considered as a critical gaming supplier and does not require authorisation by the Authority.